Divorce Property Settlement Payments Taxable . in general, property transfers between spouses as part of a divorce settlement are not taxable events. Here's how you can avoid paying taxes on a divorce settlement. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. divorce can impact a lot of your finances, especially your taxes. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. this item outlines considerations for managing and correctly timing a marital property settlement from. Consider the effect of divorce on insurance. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. Generally, there is no recognized gain or loss on the transfer of property between spouses, or between.

from www.rpemery.com

Consider the effect of divorce on insurance. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. in general, property transfers between spouses as part of a divorce settlement are not taxable events. divorce can impact a lot of your finances, especially your taxes. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. Here's how you can avoid paying taxes on a divorce settlement. Generally, there is no recognized gain or loss on the transfer of property between spouses, or between. this item outlines considerations for managing and correctly timing a marital property settlement from. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay.

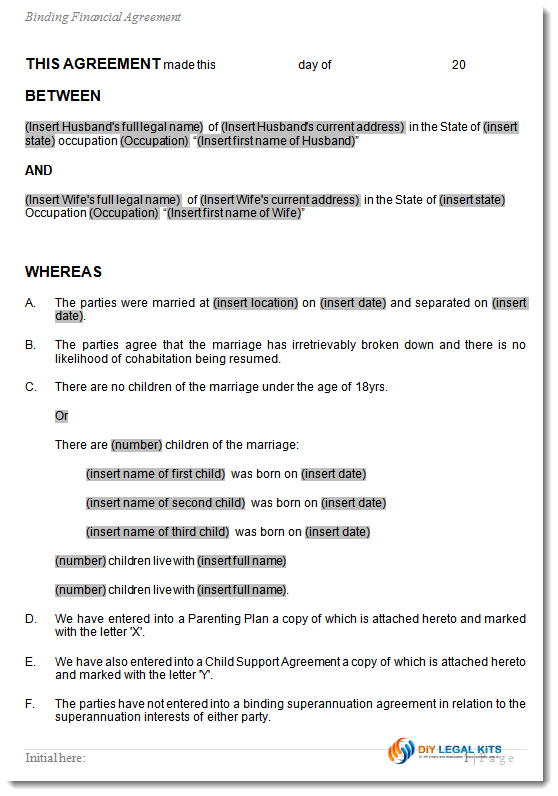

Divorce Property Settlement Financial Agreement 90D

Divorce Property Settlement Payments Taxable When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. Generally, there is no recognized gain or loss on the transfer of property between spouses, or between. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. divorce can impact a lot of your finances, especially your taxes. in general, property transfers between spouses as part of a divorce settlement are not taxable events. Here's how you can avoid paying taxes on a divorce settlement. Consider the effect of divorce on insurance. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. this item outlines considerations for managing and correctly timing a marital property settlement from.

From exoqbgfse.blob.core.windows.net

What Is A Property Settlement Agreement In A Divorce at Michelle Hamilton blog Divorce Property Settlement Payments Taxable Consider the effect of divorce on insurance. Here's how you can avoid paying taxes on a divorce settlement. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. this item outlines considerations for managing and correctly. Divorce Property Settlement Payments Taxable.

From www.pdffiller.com

What Is Divorce Settlement Agreement Fill Online, Printable, Fillable, Blank pdfFiller Divorce Property Settlement Payments Taxable in general, property transfers between spouses as part of a divorce settlement are not taxable events. Consider the effect of divorce on insurance. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. this item outlines considerations for managing and correctly timing a marital property settlement from. generally, alimony. Divorce Property Settlement Payments Taxable.

From www.austindivorceattorney.org

How New Tax Reform Impacts Your Divorce Divorce Property Settlement Payments Taxable for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. Generally, there is no recognized gain or loss on the transfer of property between spouses, or between. Here's how you can avoid paying taxes on a divorce settlement. this item outlines considerations for managing and correctly timing a marital property settlement. Divorce Property Settlement Payments Taxable.

From www.allbusinesstemplates.com

Property Divorce Settlement Agreement template Modèle Professionnel Divorce Property Settlement Payments Taxable for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. Here's how you can avoid paying taxes on a divorce settlement. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. in general, property transfers between spouses as part of a divorce settlement are not taxable. Divorce Property Settlement Payments Taxable.

From minasinternational.org

Editable Free Printable Property Settlement Agreement Form Generic Divorce Financial Agreement Divorce Property Settlement Payments Taxable generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. this item outlines considerations for managing and correctly timing a marital property settlement from. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. divorce can impact a lot of your finances,. Divorce Property Settlement Payments Taxable.

From americantemplates.com

36+ Free Sample Divorce Settlement Agreement Templates (Printable PDF) » American Templates Divorce Property Settlement Payments Taxable Generally, there is no recognized gain or loss on the transfer of property between spouses, or between. this item outlines considerations for managing and correctly timing a marital property settlement from. Consider the effect of divorce on insurance. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. divorce can. Divorce Property Settlement Payments Taxable.

From www.pdffiller.com

Property Settlement Form Fill Online, Printable, Fillable, Blank pdfFiller Divorce Property Settlement Payments Taxable Here's how you can avoid paying taxes on a divorce settlement. Consider the effect of divorce on insurance. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. this item outlines considerations for managing and correctly. Divorce Property Settlement Payments Taxable.

From www.sampletemplates.com

FREE 6+ Divorce Agreement Samples in MS Word PDF Divorce Property Settlement Payments Taxable Here's how you can avoid paying taxes on a divorce settlement. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. in general, property transfers between spouses as part of a divorce settlement are not taxable events. Generally, there is no recognized gain or loss on the transfer of property between. Divorce Property Settlement Payments Taxable.

From www.aussiedivorce.com.au

9 Myths about Property Settlement after Divorce Divorce Property Settlement Payments Taxable divorce can impact a lot of your finances, especially your taxes. Consider the effect of divorce on insurance. this item outlines considerations for managing and correctly timing a marital property settlement from. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. When a divorce settlement shifts property from one. Divorce Property Settlement Payments Taxable.

From www.typecalendar.com

Free Printable Settlement Agreement Templates [Word, PDF] Marital, Divorce Divorce Property Settlement Payments Taxable Here's how you can avoid paying taxes on a divorce settlement. in general, property transfers between spouses as part of a divorce settlement are not taxable events. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. generally, alimony or separate maintenance payments are deductible by the payer spouse and. Divorce Property Settlement Payments Taxable.

From americantemplates.com

36+ Free Sample Divorce Settlement Agreement Templates (Printable PDF) » American Templates Divorce Property Settlement Payments Taxable Here's how you can avoid paying taxes on a divorce settlement. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. divorce can impact a lot of your finances, especially your taxes. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. When. Divorce Property Settlement Payments Taxable.

From www.allbusinesstemplates.com

Property Divorce Settlement Agreement template Templates at Divorce Property Settlement Payments Taxable generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. in general, property transfers between spouses as part of a divorce settlement are not taxable events. Here's how you can avoid paying taxes on a divorce. Divorce Property Settlement Payments Taxable.

From www.blissdivorce.com

Are Divorce Settlements Taxable in California? Divorce Property Settlement Payments Taxable divorce can impact a lot of your finances, especially your taxes. Generally, there is no recognized gain or loss on the transfer of property between spouses, or between. Here's how you can avoid paying taxes on a divorce settlement. this item outlines considerations for managing and correctly timing a marital property settlement from. in general, property transfers. Divorce Property Settlement Payments Taxable.

From www.rocketlawyer.com

Free Divorce Settlement Agreement Rocket Lawyer Divorce Property Settlement Payments Taxable Here's how you can avoid paying taxes on a divorce settlement. divorce can impact a lot of your finances, especially your taxes. Generally, there is no recognized gain or loss on the transfer of property between spouses, or between. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. for a property settlement,. Divorce Property Settlement Payments Taxable.

From americantemplates.com

36+ Free Sample Divorce Settlement Agreement Templates (Printable PDF) » American Templates Divorce Property Settlement Payments Taxable When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. Generally, there is no recognized gain or loss on the transfer of property between spouses, or between. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. Consider the effect of divorce on insurance. for a. Divorce Property Settlement Payments Taxable.

From www.bryanfagan.com

Are Divorce Settlements Taxable? The Tax Implications of Divorce Divorce Property Settlement Payments Taxable for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. this item outlines considerations for managing and correctly timing a marital property settlement from. When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. Here's how you can avoid paying taxes on a divorce settlement. . Divorce Property Settlement Payments Taxable.

From americantemplates.com

36+ Free Sample Divorce Settlement Agreement Templates (Printable PDF) » American Templates Divorce Property Settlement Payments Taxable When a divorce settlement shifts property from one spouse to another, the recipient doesn't pay. this item outlines considerations for managing and correctly timing a marital property settlement from. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. in general, property transfers between spouses as part of a divorce. Divorce Property Settlement Payments Taxable.

From www.typecalendar.com

Free Printable Settlement Agreement Templates [Word, PDF] Marital, Divorce Divorce Property Settlement Payments Taxable in general, property transfers between spouses as part of a divorce settlement are not taxable events. generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient. for a property settlement, obtain or prepare a schedule of assets with tax considerations for each asset. Generally, there is no recognized gain or. Divorce Property Settlement Payments Taxable.